Living in a material world

To reach the COP28 target to triple renewables capacity by 2030, we would need worldwide energy storage capacity to grow by about 16 times by 2030 (BNEF). This implies greater extraction of finite natural resources to feed growing demand for batteries.

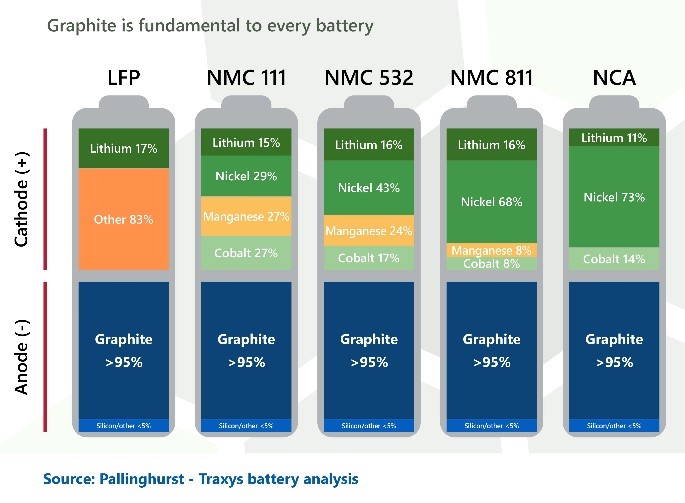

At the moment, lithium-ion (or li-ion) batteries dominate stationary energy storage and electric vehicles (EV) markets. In 2022, EV batteries with a cathode made with nickel, cobalt and manganese (NMC) commanded a market share of 60%, ahead of lithium iron phosphate (LFP) with a share of just under 30%, and nickel cobalt aluminium oxide (NCA) with a share of about 8% (IEA).

Types of cathode formulations in batteries: LFP, NMC, NCA.

Types of cathode formulations in batteries: LFP, NMC, NCA.

Photo: European Carbon and Graphite Association, Pallinghurst-Traxys

NMC batteries offer a longer range (via higher energy density) and faster charging speeds, though they are more prone to overheating. Meanwhile, LFP batteries have been gaining popularity due to their longer lifespan – 2 to 3 times that of NMC batteries – and cost-effectiveness. The LFP battery needs fewer battery replacements, reducing maintenance costs. LFP batteries also omit the need for nickel ore and cobalt mining – which has raised concerns over water and thermal pollution and poor working conditions at informal mining sites in the Democratic Republic of Congo and Southeast Asia.

Sodium-ion batteries could offer a cheaper, lithium-free alternative to li-ion batteries for the EV industry. Though sodium formulations have a lower cycle life and lower energy density, sodium is more abundant than lithium – making it less susceptible to supply constraints and price volatility (McKinsey). Sodium-ion batteries also enjoy a less complex, more cost-effective recycling process. As for energy storage, BloombergNEF analysis shows that sodium-ion batteries could account for over one-fifth of the market (over 50 GWh) by 2030.

China, the world’s third-largest producer (13%) of lithium, hosts nearly 60% of the world’s lithium refining capacity for batteries. For EVs to travel further, EV makers would need more compact batteries – a challenge for LFP batteries which tend to be bulkier than NMC types. LFP batteries tend to be more popular in China, while drivers in the US and Europe lean towards vehicles with longer range. With better, longer-lasting LFP batteries and greater availability of charging points, we could see greater adoption by range-aware customers across markets.

By recycling batteries, it is possible to recover the value of metals while closing the loop. The EU has agreed on a new law for more sustainable and circular batteries, with mandatory minimum levels of recycled content for cobalt, lithium and nickel. However, the EU’s lack of processing capacity means that black mass (shredded material from batteries) is exported to other markets – which could create pollution issues.

Southeast Asia’s biggest battery storage project

In Singapore, we rely on LFP cells for energy storage. Completed in February 2023, Singapore surpassed its 2025 energy storage target three years ahead of schedule (200MW by 2025). The 200MW/285Mwh project will help mitigate intermittency of renewables. This is crucial as Singapore ramps up solar deployment towards its 2025 target of 2GWp – enough to support annual electricity needs of around 350,000 households.

Looking forward

Securing sustainable supply for critical raw materials is needed to power the energy revolution. The surge in electric vehicles sales and energy storage needs has driven demand for minerals like cobalt and nickel, with unregulated miners working in poor conditions. We could see cobalt and nickel taken out of supply chains as alternatives like sodium-ion batteries enter the race. This is why it is important for us to see how progressive a company is in adopting new technology. Under PCM ESG Research Objective 2 (Mitigating Negative Externalities), we support companies which ensure sustainable practices within their supply chains. We favour companies that are positioned to progressively reduce their dependence on natural resource extraction, employ innovative processes and exercise positive influence over their supply chains.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.