Carbon pricing to anchor emissions

- Growing support for pricing the shipping sector’s emissions could accelerate the transition towards the IMO’s target to reach net-zero GHG emissions by or around 2050

- Emissions pricing will provide shipping companies with an incentive to build and upgrade vessels suitable for low-carbon fuels to lower emissions

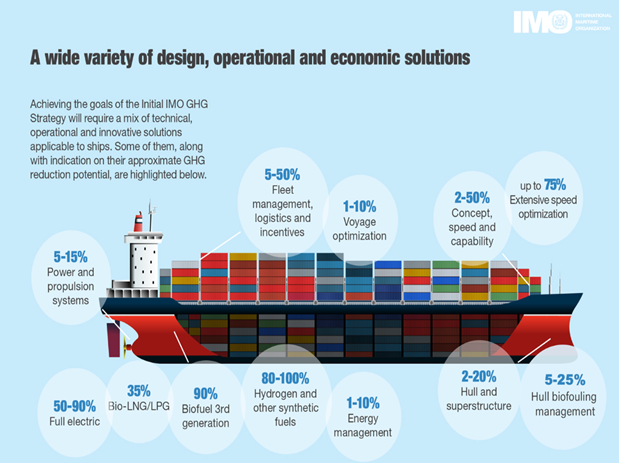

The shipping industry is confronting a shifting regulatory landscape. Carbon pricing for international maritime trade is expected to be finalised by end-2024 and come into force by 2027. Shipping companies will need to design and equip existing vessels. For instance, Maersk intends to replace existing cargo ships with models powered by methanol, bringing in about $56 million in cost savings annually.

Photo source: IMO

Photo source: IMO

Technology and infrastructure for alternatives to fossil fuels need to be ready for offtake for the sector to achieve the IMO’s net-zero ambitions. The Maritime and Port Authority (MPA) of Singapore expects to see ammonia bunkering within its waters from 2026. With ships having a lifespan of up to 30 years, new ships need to be designed to be able to utilise new fuels once they are available for market adoption.

A carbon price could also boost maritime interest in green bonds by issuers. Green bonds can finance projects such as retrofitting existing ships with energy-saving technologies, development of clean marine fuels, and refueling infrastructure for zero emissions ships. For instance, a Danish shipping company is using green bonds to support global expansion of green methanol supply to secure volumes to meet its 2030 targets, while building new ships with dual-fuel engines that can switch to green methanol.

In the meantime, shipping companies are looking to curb emissions by reducing fleet speeds. One ship uses as much fuel as 40,000 households in just one day – reducing fuel consumption could offer major emissions savings. For example, a Japanese container shipping company expects carbon emissions to fall by at least 15% with a 10% drop in speed.

Photos: IRENA

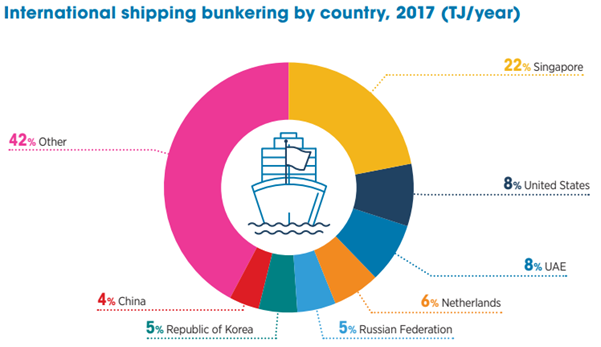

International shipping could connect growing green fuel producers such as China and Australia with the rest of the world. New agreements linking shipping hubs, such as the recently established Singapore-Australia green and digital shipping corridor, are expected to fast-track the development and uptake of cleaner technologies. Bunkering is a key part of the port infrastructure that enables the storage and resupply of ship fuels. As the world’s largest bunkering hub (22% of energy supplied), Singapore has a unique opportunity to take the lead in fast-forwarding market adoption of cleaner marine fuels. Already, trials and studies with corporate partners are underway to develop an ammonia fuel supply chain in Singapore.

Looking forward

Decarbonising shipping could unlock a global energy transition with implications for energy, consumer goods, infrastructure, and finance sectors. We need a clear path to support the rapid uptake of cleaner marine fuels over the following decades. In our assessments, we look for companies that enable the green transition and reinforce commitments to emissions reductions aligned with the IMO’s net-zero target. This approach incentivises companies to invest in solutions that meet future regulatory demands and contribute to a more sustainable maritime sector.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.