Growing for Tomorrow: Regenerative Agriculture

- Within 50 years, the world could run out of soil to feed global populations due to erosion, excessive tillage, and over-reliance on fertilisers

- We need better farming practices: Regenerative agriculture can improve soil health, decrease fertiliser use and produce more food and nutrition

We need soil to grow our food. However, current farming practices are leading to erosion and land degradation – linked to losses of US$400 billion per year. To compensate for losing important nutrients like nitrogen and phosphorus, more fertiliser is applied to boost yields. However, excess fertiliser can enter aquatic bodies through soil erosion and runoff, causing algal blooms.

Photo source: Groundswell

Photo source: Groundswell

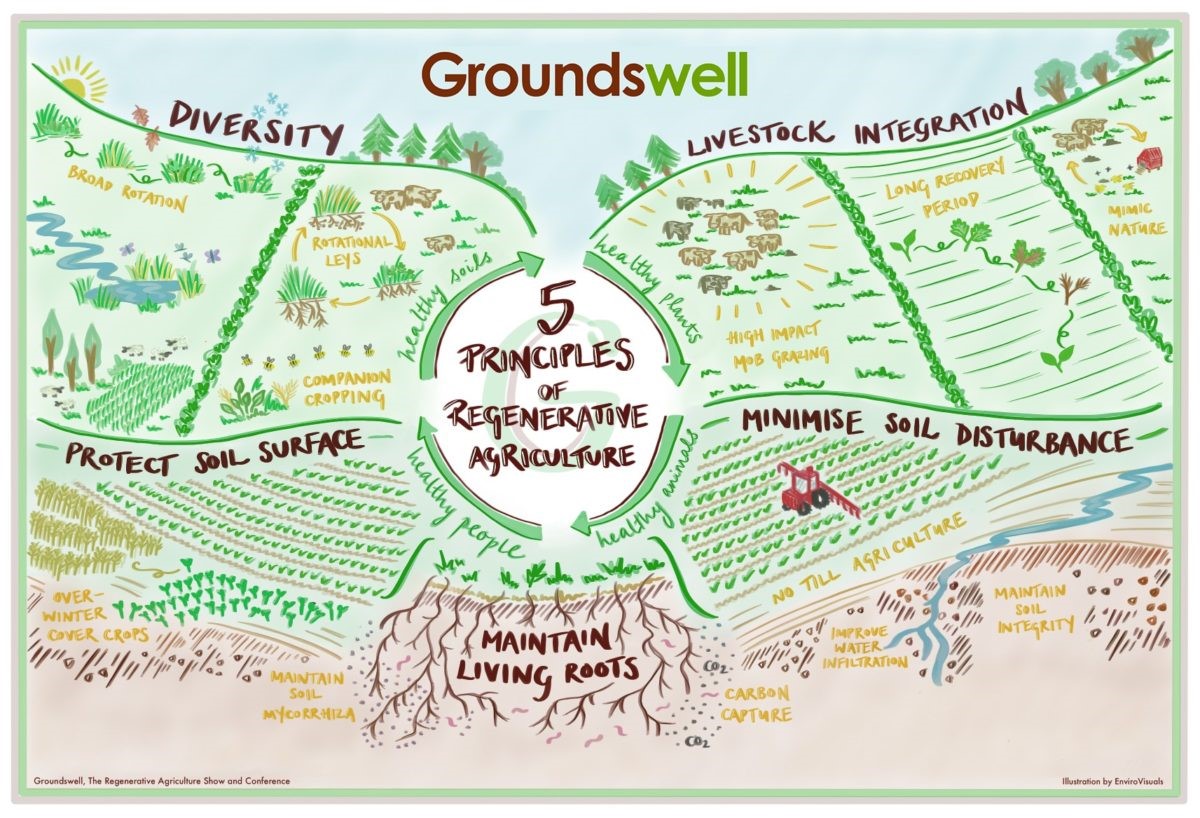

Practices such as regenerative agriculture aim to build healthy, fertile soil on farmed lands. This involves using minimal inputs, cultivating two or more crop types on the same field, and planting crops specialised in managing soil erosion. Focusing on soil health and storing carbon could provide additional revenue streams, and incentivise firms to move away from traditional mono-culture production methods. In addition, better stability means that excess nutrients are less likely to escape into water bodies. This could help companies save costs on fertiliser and shifting operations to new lands, all while maintaining soil yields.

We cannot solve the global food production challenge by relying on existing practices. At present, regenerative agriculture has been implemented for rice plantations and oil palm farms. Southeast Asia is a leading agricultural exporter – providing 90% of global rice production and 85% of global oil palm production. However, the resources making the region agronomically viable are slowly being depleted as Southeast Asia observes declining soil fertility, water scarcity, and biodiversity loss. Meanwhile, it is estimated that the world will need land half the size of China to meet food demand by 2050. By embracing the principles outlined in the 2030 ASEAN Action Plan, Southeast Asia can close this gap and unlock the potential for sustainable growth, innovation, and impact in the food, agriculture, and forestry sectors.

Looking forward

In our environmental analysis, we reinforce actions by companies contributing towards the sustainable transformation of the food system e.g. supporting biodiversity recovery, boosting soil health, and curbing pollution. By incorporating these criteria into our investment decisions, we increase momentum toward achieving global biodiversity targets. For instance, reducing pressure on ecosystems from erosion and fertiliser pollution contributes to overall biodiversity recovery under Target 2 of the Kunming-Montreal Global Biodiversity Framework.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.