A Better Way To Manage Surplus Cash & Case Study Of A Government Agency

Idle cash is generally a neglected aspect amongst the business community. In Singapore, where banks savings deposits average about 0.16% per annum*, idle cash in bank accounts do not work as hard. Ironically, despite the liquidity of bank accounts, business owners tend to let funds build up inertia subconsciously. This can impede the timely flow of cash into potential business or investment opportunities.

The genesis of money market funds as an effective alternative cash management tool for businesses had largely been underappreciated in Singapore. However, there is a growing trend of adoption as the community becomes more savvy, which helps in dispelling some past misconceptions about money market funds.

One major hurdle for acceleration of local adoption has been the fact that money market funds are not insured by the Singapore Depository Insurance Corporation (“SDIC”). However, as money market funds invest into high quality# money market securities and instruments issued by institutions, government entities and corporations, the risk of default is mitigated while generating slightly higher yields on investors’ monies.

As one of the pioneers in Singapore’s money market funds, Phillip Capital Management (“PCM”) has been leading the drive in the adoption of money market funds for retail savers, businesses and institutions to leverage on money market funds as an effective alternative cash management tool. Due to Phillip Money Market Fund’s (“PMMF”) large fund size, PMMF is able to maintain substantial cash float during uncertain periods such as the current pandemic and continue to meet daily redemptions**. This ability to meet investors’ liquidity needs, coupled with the enhanced returns on surplus cash helps investors better utilize their idle monies more efficiently while waiting to deploy the monies into potential business or investment opportunities.

There are several additional benefits to being the largest Singapore dollar-denominated money market fund. One major advantage of the PMMF’s large fund size and substantial cash float is that it enables the professional fund managers to pick-up quality assets at better rates during downturns like the current coronavirus pandemic. In fact, during this challenging period, some financial institutions have turned to PMMF to support their short-term liquidity needs, in return for slightly higher rate of return for PMMF compared to existing assets in the marketplace. In addition, holdings of money market securities and instruments can be meaningfully diversified and maturities laddered to achieve the intended interest-rate stability for PMMF.

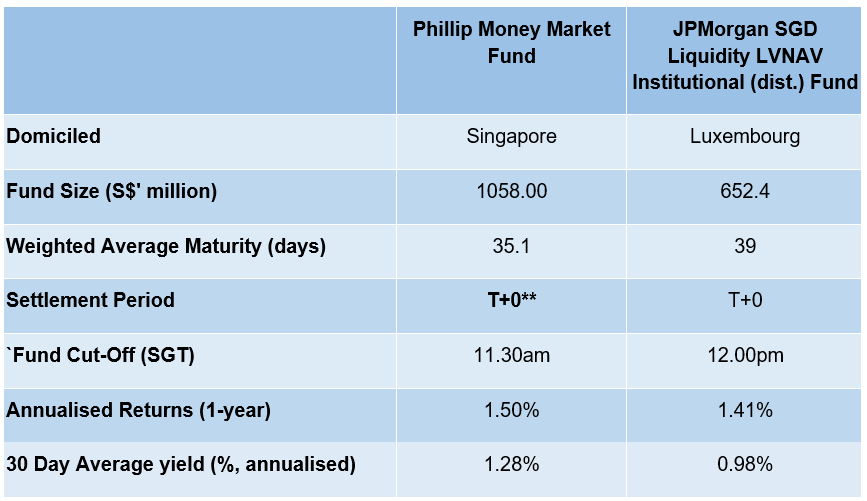

PMMF is the only Singapore-domiciled Singapore dollar-denominated money market fund with institutional class (“I Class”) shares. There is one other fund denominated in Singapore dollar with I-Class shares which is the offshore (Luxembourg) JPMorgan SGD Liquidity LVNAV Institutional (dist.) Fund.

Table 1: Singapore Dollar Money Market Funds (I Class) Profile Source: PCM, JPMorgan; As of 31 March 2020

Source: PCM, JPMorgan; As of 31 March 2020

|

CASE HIGHLIGHT: GOVERNMENT AGENCY |

|

Prior to the Global Financial Crisis in 2008, a Government Agency was searching for facilities to generate a more favourable return for its daily surplus cash flow which was lying idle in the bank. The nature of the public fund meant that the Government Agency had the duty to safeguard the principal and maintain short-term liquidity. The Government Agency made their evaluation based on these factors:

The decision was made to allocate the funds to PMMF due to these reasons:

During the Global Financial Crisis, the Agency requested the full-redemption of its funds which PCM delivered. Satisfied with the qualities of the fund, the Agency returned to park funds in PMMF once again from 2016 to 2017. |

Ms. Sabrina Loh, Investment Director at PCM, highlights that “the greater emphasis on prudence instead of performance has been the hallmark of PMMF. Testament to the importance of this, PMMF is still seeing net positive inflows during this COVID-19 crisis period. In fact, PMMF just reached a significant milestone of hitting $1 billion in asset under management (“AUM”) in March 2020”.

“The fact that PMMF grew its AUM significantly (during the same period), indicates that the market and more investors continue to embrace our highly defensive strategies,” she added.

Businesses not taking advantage of money market funds might be missing out. Ms. Loh elaborated: “Even regardless of the investment climate, idle resources are unproductive. If the performance of PMMF is compared to interest rates of Singapore deposit accounts and used as a measure for productivity, PMMF would appear many times more efficient.”

See other ways of how PMMF can help address the “dilemma” for businesses.

# “high quality” as defined in the Appendix 2 of the Code on Collective Investment Schemes (last revised on 16 April 2020).

* Interest Rates of Banks and Finance Companies, Monetary Authority of Singapore

** For direct clients only. Redemptions via other distribution channels will be subjected to redemption policies set by distributors.

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.