Intraday NAV

9 July 2025, 5:59 pm

9 July 2025, 5:59 pm

– / –

1-Year Rolling

Invest in China’s 50 Leading Companies

The Phillip China Universal MSCI China A 50 Connect ETF is the first ETF listed on SGX tracking the MSCI China A 50 Connect Index through feeding at least 90% of its assets into the underlying fund, CUAM MSCI China A50 Connect Exchange Traded Fund (the “Underlying Fund”)

The Underlying Fund is an exchange traded fund listed on the Shanghai Stock Exchange (‘SHSE“) that tracks the performance of the Index by investing at least 80% of its non-cash assets in securities which are constituent securities and alternative constituent securities of the Index (“Index Securities“) and is managed by China Universal Asset Management Co. Ltd

To provide investment results that, before fees, costs and expenses (including any taxes and withholding taxes), closely correspond to the performance of the MSCI China A 50 Connect Index

Efficient way to to access 50 leading companies in China’s A-shares market

Exposure to the second-largest GDP country at a low valuation level

Low management fee (0.01% per annum)

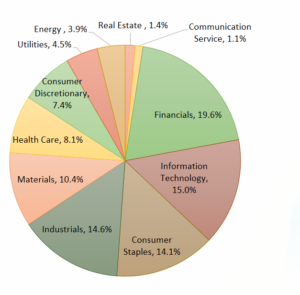

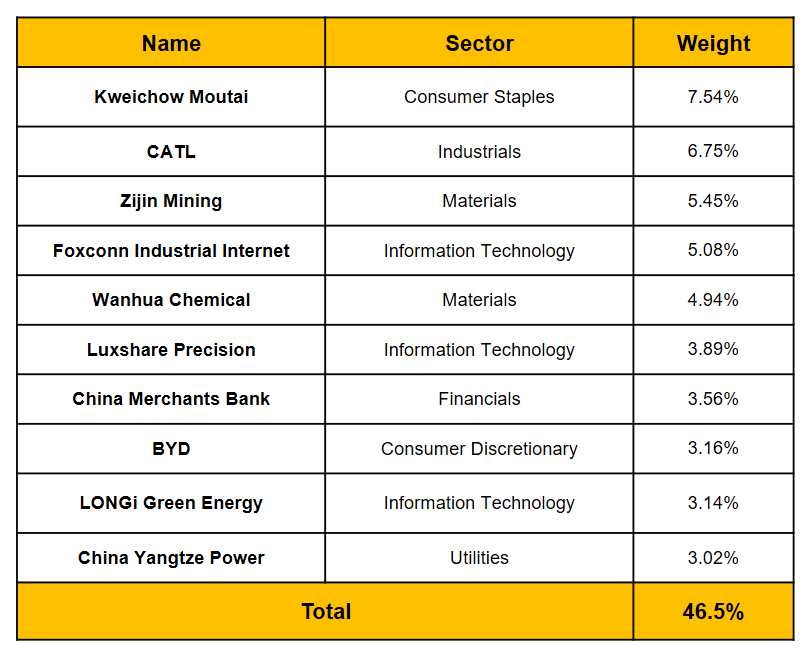

Diversified sector allocation

The MSCI China A 50 Connect Index (the “Index“) is constructed from the MSCI China A Index (the “Parent Index“). The Index aims to reflect the performance of the 50 largest securities representing each Global Industry Classification Standard (GICS®) sector and reflecting the sector weight allocation of the Parent Index

Individual foreign investors still face restrictions on direct access to the mainland Chinese stock market. Through the Phillip-China Universal MSCI China A 50 Connect ETF, investors are able to access China A shares, offering access to a dynamic and high-growth market less exposed to global fluctuations. The ETF allows investors access to 50 leading companies in various industries in China’s A-shares through 1- click.

China boasts a rapid GDP growth rate, potentially outpacing developed markets. Its share of global GDP continues to rise, with an estimated nearly 20% of global GDP. As the world’s second-largest stock market, it presents an undeniable investment opportunity. It is time to access the Chinese market at a low valuation.

According to the index methodology, the ETF invests in leading enterprises with a diversified sector allocation.

Excluded Investment Product (EIP)

Investment from as low as S$1.000

Trading currencies include SGD and USD

Listed on SGX

Investment using cash/Supplementary Retirement Scheme

| Reference Benchmark | MSCI China A 50 Connect Index |

| Fund Manager | Phillip Capital Management (S) Ltd |

| Underlying Fund | CUAM MSCI China A50 Connect ETF |

| Underlying Fund Manager | China Universal Asset Management Co., Ltd |

| Investment Advisor | China Universal Asset Management (Singapore) Pte. Ltd. |

| Base Currency | SGD |

| Trading Currency | SGD, USD |

| SGX Code | PHIL-CU MS CHINA A50 S$ (primary currency) (stock code: MCN)

PHIL-CU MS CHINA A50 US$ (secondary currency) (stock code: MCS) |

| Issue Price | SGD $1.000 |

| Inital Offer Period | 4th March – 14th March 2024 |

| Listing Date | 20 March 2024 |

| Trading Board Lot Size | 1 Unit |

| Management Fee | Feeder ETF: Currently 0.01% p.a. (max 0.10% p.a.)

Underlying Fund: Currently 0.50% p.a. |

| Trustee Fee | Feeder ETF: Currently 0.02% p.a. (max 0.10% p.a.) |

| Custodian Fee | Feeder ETF: May exceed 0.10% p.a.

Underlying Fund: Currently 0.10% p.a. |

| Designated Market Maker | Phillip Securities Pte. Ltd |

| Participating Dealers | Phillip Securities Pte. Ltd

Moomoo Financial Singapore Pte. Ltd (for Initial Offer Period only) |

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the ETF and obtain advice from a financial adviser (“FA“) pursuant to a separate engagement before invest in the ETF. In the event that you choose not to obtain advice from a FA, you should assess whether the ETF are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM and any of its Participating Dealers (“PDs“).

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested. The purchase of a unit in a fund is not the same as placing your money on deposit with a bank or deposit-taking company. There is no guarantee as to the amount of capital invested or return received. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the ETF. There can be no assurance that investment objectives will be achieved.

Where applicable, the ETF may invest in financial derivatives and/or participate in securities lending and repurchase transactions for the purpose of hedging and/or efficient portfolio management, subject to the relevant regulatory requirements. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The ETF is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF. Any member of the PhillipCapital Group of Companies may have acted upon or used the information, analyses and opinions herein before they have been published.

The Phillip-China Universal MSCI China A 50 Connect ETF will be listed on the SGX and it is tracking the MSCI China A 50 Connect Index through feeding at least 90% of its assets into the underlying fund, CUAM MSCI China A50 Connect Exchange Traded Fund that is listed on the Shanghai Stock Exchange and is manage by China Universal Asset Management Co., Ltd.

By accessing and using this website (the “Website”) and any web page hereof, you agree to be bound by the terms and conditions below. Reference to these general terms of use should be made each time you access and use the Website.

This Website, its services and contents are provided for your use by PhillipCapital, which is a group of companies who together offer a full range of financial services to retail, corporate and institutional customers. Member companies in Singapore include Phillip Securities Pte Ltd, Phillip Securities Research Pte Ltd, Phillip Financial Pte Ltd, Phillip Futures Pte Ltd, Phillip Trading Pte Ltd, Phillip Capital Management (S) Ltd, Phillip Private Equity Pte Ltd, Phillip Japan Fund Management Pte Ltd, CyberQuote Pte Ltd, IFS Capital Limited and ECICS Limited. Member companies can otherwise be identified by their authorised use of PhillipCapital brand name along with their own name in their documentation and literature.

The contents of this website are provided to you for general information only and should not be used as a recommendation or basis for making any specific investment, business or commercial decision. These pages should not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the securities, and specifically funds or any investment products, mentioned herein, or, in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdiction. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of you acting based on this information. Unit trusts distributed by Phillip Securities Pte Ltd are not obligations of, deposits in, or guaranteed by, Phillip Securities Pte Ltd or any of its affiliates. All applications for units in a unit trust must be made on application forms accompanying the relevant prospectus. You should read the prospectus before deciding to subscribe for units in the respective fund. A copy of the prospectus can be obtained from Phillip Securities Pte Ltd or online at www.poems.com.sg/unittrust.

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products.

The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the Applicable Conditions governing each account and the relevant Risk Disclosure Statement, if any, carefully before investing in any of our products. The contents of this website, including these terms and conditions, are subject to change and may be modified, deleted or replaced from time to time and at any time at the sole and absolute discretion of PhillipCapital.

In particular, we assume no responsibility for or make any representations, endorsements, or warranties whatsoever in relation to the timeliness, accuracy and completeness of any services, content, information and/or data contained in the Website, whether provided by us, any content providers or third parties.

PhillipCapital and/or its member companies reserve all copyright and intellectual property rights to the services, content, information and data on the Website. The contents in the Website are protected by copyright and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, hyperlinked, used for creating derivative works or used in any other way for commercial or public purposes without the prior written consent of PhillipCapital and/or its member companies.

While every care has been taken in preparing the contents contained in the Website, such contents are provided to you “as is” and “as available” without warranty of any kind either express or implied. In particular, no warranty regarding non-infringement, security, accuracy, fitness for a particular purpose or freedom from computer virus is given in conjunction with such contents. Member companies of PhillipCapital, their directors, officers, associates, agents and affiliates make no representations, endorsements or warranties of any kind about the services, content, information and/or data contained in the Website.

The provision of any service or products provided by PhillipCapital and/or its member companies through the Website shall be expressly subject to the particular terms and conditions as contained in the contract for the supply of such service or product. Any warranties or representations made in relation to the provision of such service or product are as made in the contract only and PhillipCapital and/or its member companies make no separate warranty or representation through the Website or through these general terms of use.

In no event shall PhillipCapital and/or its member companies be liable to you for any loss, damage, costs, charges and/or expenses of whatsoever nature and howsoever arising including legal fees on a full indemnity basis, cost of funding and loss or cost incurred by you as a result of or in connection with:

These general terms of use shall be governed by and construed in accordance with the laws of the Republic of Singapore and all parties hereby agree to submit to the exclusive jurisdiction of the courts of the Republic of Singapore.

Products and services referred to in this website are offered only in jurisdictions where and when they may be lawfully offered by PhillipCapital and/or its member companies. The contents in the Website are not intended for use by persons located in or resident in jurisdictions that restrict the distribution of such materials by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. The terms and conditions governing the use of the Website of each member company of PhillipCapital may differ and you should consult and carefully read the applicable terms and conditions before using the website.

With effect from 1st July 2014, this FATCA Notice (the “Notice”) forms part of the terms and conditions of our products and services (the “Terms and Conditions”) governing your relationship (“you”, “your”, “yours” referred to herein include joint-account holders and beneficiary holders of an entity who are a natural person) with Phillip Capital Management (S) Ltd and its related corporations (collectively referred to herein as “PCM”, “us”, “we” or “our”) and should be read in conjunction with those Terms and Conditions, including those under our Personal Data Protection Notice.The existing terms and conditions of any contractual agreement entered into between PCM a nd you (the “Existing Terms and Conditions”) remain in full force and effect. In the event of any conflict or inconsistency between the provisions of this Notice and those of the Existing Terms and Conditions, the provisions of this Notice shall prevail.

We may from time to time update the Terms and Conditions listed here to ensure their consistency with our future developments,industry trends and/or any changes in legal or regulatory requirements. Such updates will be published at http://www.phillipfunds.com/ .

On March 18, 2010, the United States of America’s (“U.S.”) Hiring Incentives to Restore Employment Act of 2010 (Pub.L.111-147H.R.2847)) (the “Act”) was enacted into law. Section 501(a) of the Act added a new chapter 4 (sections 1471-1474) to Subtitle A of the U.S.’s Internal Revenue Code (Code).Chapter 4 expands the information reporting requirements imposed on foreign financial institutions (as defined in section 1471(d)(4)) (FFIs) with respect to certain U.S. accounts (as defined in section 1471(d)(1)) of specified U.S. person, and imposes withholding, documentation, and reporting requirements with respect to certain payments made to certain foreign entities.

PCM will be obliged to comply with the provisions of FATCA under the terms of the inter-governmental agreement (“IGA”) Model I between the U.S. and Singapore and under the terms of Singapore’s subsidiary legislation which will be issued pursuant to Singapore’s Income Tax Act (Cap. 134) to implement the IGA. “FATCA” or “Foreign Account Tax Compliance Act” means Chapter 4 (sections 1471 to 1474) to Subtitle A of the U.S. Internal Revenue Code.

“FATCA” or “Foreign Account Tax Compliance Act” means Chapter 4 (sections 1471 to 1474) to Subtitle A of the U.S.Internal Revenue Code.

“U.S. person” means a U.S. citizen or resident individual, a partnership or corporation organised in the U.S. or under the laws of the U.S. or any state of the U.S. thereof, a trust if: (i) a court within the U.S.would have authority under the applicable law to render orders or judgments concerning substantially all issues regarding the administration of the trust; and (ii) one or more U.S. persons have the authority to control all substantial decisions of the trust, or an estate of a decedent that is a citizen or resident of the U.S..This definition shall be interpreted in accordance with the provisions of the U.S. Internal Revenue Code.

PERSONAL DATA PROTECTION NOTICE

With effect from 1st July 2014, this Personal Data Protection Notice (the “Notice”) forms part of the terms and conditions of our products and services (the “Terms and Conditions”) governing your relationship (“you”, “your”, “yours” referred to herein include joint-account holders and beneficiary holders of an entity who are a natural person) with Phillip Capital Management (S) Ltd and its related corporations (collectively referred to herein as “PCM”, “us”, “we” or “our”). Without prejudice to the existing terms and conditions of any contractual agreement entered into between PCM and you (the “Existing Terms and Conditions”), which remain in full force and effect, this Notice shall be read in conjunction with the Existing Terms and Conditions. In the event of any conflict or inconsistency between the provisions of this Notice and those of the Existing Terms and Conditions, the provisions of this Notice shall prevail.

We are required under the Personal Data Protection Act (“PDPA”) to put in place the necessary arrangements to protect personal data and comply with the PDPA. Personal data includes any data and information, whether true or not, about an individual (a natural person) who can be identified from that data or information, such as your name, NRIC, passport or other identification number, telephone numbers, address, email address and any other information relating to individuals which you or your authorized representative have provided to us or we are likely to have access to (“Personal Data”).

This Notice outlines the purposes for the collection, use and/or disclosure of your Personal Data by PCM, how we protect your Personal Data and your rights with respect to the collection, use and/or disclosure of your Personal Data. This Notice supplements but does not supersede nor replace any other consents which you may have previously provided to us in respect of your Personal Data, and your consents herein are additional to any rights which we may have at law to collect, use and/or disclose your Personal Data. We may from time to time update the Terms and Conditions listed here to ensure their consistency with our future developments, industry trends and/or any changes in legal or regulatory requirements. Such updates will be published at http://www.phillipfunds.com/.

1. PCM may collect, use and/or disclose your personal data for any of the following purposes listed below (collectively “Permitted Purposes”):-

i) carrying out activities, duties and obligations in connection with our products and services which you have applied for, including evaluating your eligibility and credit profile, verifying the identity or authority of your representatives, administration of your account and/or managing our overall relationship with you (including but not limited to the outsourcing of any of our functions to service providers or vendors, due diligence checks, accounting and portfolio valuation, billing and collections, business continuity and print management);

(ii) developing new services and/or products;

(iii) providing you with marketing, advertising and promotional information, materials and/or documents related to financial products and/or services that we may be selling, marketing, offering or promoting, whether such financial products or services exist now or are created in the future;

(iv) marketing and promotional events, including but not limited to images, photographs or videos of you during the events;

(v) meeting or complying with PCM’s internal policies and procedures and any applicable rules, law, regulations, codes of practice or guidelines, orders or requests issued by any court, legal or regulatory bodies (both national and international) (including but not limited to disclosures to regulatory authorities or financial industry self-regulatory bodies; conducting audit checks (internal/external), surveillance and investigation; handling of customer feedback or complaint; dispute resolutions; recording of telephone conversations and/or electronic communications with you; conducting checks or investigations for prevention and/or detection of financial crimes such as money-laundering, financing of terrorism, fraud and/or bribery etc.);

(vi) legal purposes, including but not limited to obtaining legal advice and enforcing or defending our legal and/or contractual rights against you;

(vii) risk management, statistical and trend analysis;

(viii) processing and/or storing data and/or information related to your relationship with PCM.

2. PCM, in order to facilitate the discharge of its duties and obligations to you, may be required to disclose your Personal Data for the Permitted Purposes and/or for processing of the Permitted Purposes on a need-to-know basis, to any of the following entities and the directors, officers, staff, employees and agents of any such entities, whether located within or outside Singapore (“Relevant Persons”):-

(i) any associate or related company of PCM and the directors, officers, staff, employees and agents of any such person;

(ii) any actual or proposed assignee or transferee of any of PCM’s rights and obligations or any actual or proposed delegate of any of PCM’s functions and duties under its contractual relationship with you;

(iii) any relevant governmental, supervisory or regulatory authority or court of law, including the Monetary Authority of Singapore, to which PCM is or may be subject;

(ix) any person in order to give effect to any instruction from you or any person acting or purporting to be acting on behalf of you;

(x) any person as PCM may consider necessary in order to comply with any order, directive or policy of any court or governmental or regulatory authority in any jurisdiction;

(xi) any person when required to do so in accordance with the laws of any applicable jurisdiction or rules of any professional self-regulatory bodies or securities exchanges;

(xii) any agent, contractor or third party service provider who provides their services in connection with the operation of PCM’s fund management business, including but not limited to the custodians, trustees, fund administrators, registrars, banks, legal firms, accounting and auditing firms, printing firms, IT service providers, credit reference agencies, credit bureaus, data screening entities for the purpose of due diligence checks and the prevention and detection of financial crimes.

3. PCM’s related companies and third party service providers shall be bound by the same provisions as set out in this Notice and we will require them to ensure that your Personal Data are kept confidential and secure.

4. You represent and warrant that your Personal Data provided to us is accurate and complete for us to make a decision that affects you or to disclose your Personal Data to the above-mentioned Relevant Persons on a need-to-know basis. Where applicable, when you provided Personal Data relating to another individual (e.g. your dependent, spouse, children and/or parents) to us, you represent and warrant that such Personal Data is accurate and complete and the consent of that individual has been obtained for the collection, use and disclosure of his/her Personal Data in accordance with the provisions listed in this Notice.

5. We will retain your Personal Data to the extent that one or more of the Purposes for which your Personal Data was collected, used and/or disclosed is/are still valid and for legal, regulatory reporting or regulatory investigations purposes for which retention may be necessary.

6. PCM may terminate any contractual relationship which you may have with us, if any information provided to us is insufficient, misleading or erroneous or if any information that is required to be disclosed to any regulatory authority for compliance with any law or regulation is not provided by you.

7. You may request access to or make corrections to your Personal Data records. Depending on the information requested PCM may charge a small fee when you request access to your Personal Data. Upon your request and subject to the provisions under the PDPA, PCM will respond accordingly within reasonably possible time. Please submit your request to our Data Protection Officer via [email protected].

8. You may withdraw your consent to any use or disclosure of your Personal Data for any or all of the Purposes as set out in this Notice by giving written notice to us. If you withdraw your consent(s), depending on the nature of your request, we may not be in a position to continue to provide our products or services to you or administer any contractual relationship in place. Such withdrawal may be considered a termination by you of any agreement you may have with us. Where there is any breach of your contractual obligations or undertakings, PCM’s legal rights and remedies are expressly reserved in such event.

By accessing and using this website (the “Website”) and any web page hereof, you agree to be bound by the terms and conditions below. Reference to these general terms of use should be made each time you access and use the Website.

This Website, its services and contents are provided for your use by PhillipCapital, which is a group of companies who together offer a full range of financial services to retail, corporate and institutional customers. Member companies in Singapore include Phillip Securities Pte Ltd, Phillip Securities Research Pte Ltd, Phillip Financial Pte Ltd, Phillip Futures Pte Ltd, Phillip Trading Pte Ltd, Phillip Capital Management (S) Ltd, Phillip Private Equity Pte Ltd, Phillip Japan Fund Management Pte Ltd, CyberQuote Pte Ltd, IFS Capital Limited and ECICS Limited. Member companies can otherwise be identified by their authorised use of PhillipCapital brand name along with their own name in their documentation and literature.

The contents of this website are provided to you for general information only and should not be used as a recommendation or basis for making any specific investment, business or commercial decision. These pages should not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the securities, and specifically funds or any investment products, mentioned herein, or, in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdiction. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of you acting based on this information. Unit trusts distributed by Phillip Securities Pte Ltd are not obligations of, deposits in, or guaranteed by, Phillip Securities Pte Ltd or any of its affiliates. All applications for units in a unit trust must be made on application forms accompanying the relevant prospectus. You should read the prospectus before deciding to subscribe for units in the respective fund. A copy of the prospectus can be obtained from Phillip Securities Pte Ltd or online at www.poems.com.sg/unittrust.

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units in any fund and the income from them may fall as well as rise. If the investment is denominated in a foreign currency, factors including but not limited to changes in exchange rates may have an adverse effect on the value, price or income of an investment. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products.

The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the Applicable Conditions governing each account and the relevant Risk Disclosure Statement, if any, carefully before investing in any of our products. The contents of this website, including these terms and conditions, are subject to change and may be modified, deleted or replaced from time to time and at any time at the sole and absolute discretion of PhillipCapital.

In particular, we assume no responsibility for or make any representations, endorsements, or warranties whatsoever in relation to the timeliness, accuracy and completeness of any services, content, information and/or data contained in the Website, whether provided by us, any content providers or third parties.

PhillipCapital and/or its member companies reserve all copyright and intellectual property rights to the services, content, information and data on the Website. The contents in the Website are protected by copyright and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, hyperlinked, used for creating derivative works or used in any other way for commercial or public purposes without the prior written consent of PhillipCapital and/or its member companies.

While every care has been taken in preparing the contents contained in the Website, such contents are provided to you “as is” and “as available” without warranty of any kind either express or implied. In particular, no warranty regarding non-infringement, security, accuracy, fitness for a particular purpose or freedom from computer virus is given in conjunction with such contents. Member companies of PhillipCapital, their directors, officers, associates, agents and affiliates make no representations, endorsements or warranties of any kind about the services, content, information and/or data contained in the Website.

The provision of any service or products provided by PhillipCapital and/or its member companies through the Website shall be expressly subject to the particular terms and conditions as contained in the contract for the supply of such service or product. Any warranties or representations made in relation to the provision of such service or product are as made in the contract only and PhillipCapital and/or its member companies make no separate warranty or representation through the Website or through these general terms of use.

In no event shall PhillipCapital and/or its member companies be liable to you for any loss, damage, costs, charges and/or expenses of whatsoever nature and howsoever arising including legal fees on a full indemnity basis, cost of funding and loss or cost incurred by you as a result of or in connection with:

These general terms of use shall be governed by and construed in accordance with the laws of the Republic of Singapore and all parties hereby agree to submit to the exclusive jurisdiction of the courts of the Republic of Singapore.

Products and services referred to in this website are offered only in jurisdictions where and when they may be lawfully offered by PhillipCapital and/or its member companies. The contents in the Website are not intended for use by persons located in or resident in jurisdictions that restrict the distribution of such materials by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. The terms and conditions governing the use of the Website of each member company of PhillipCapital may differ and you should consult and carefully read the applicable terms and conditions before using the website.

Apart from personal data, we may collect other types of information which is not linked to an individual and which is anonymous. For example, the number of website visitors and the number of website users using a particular service. In this way, we hope to improve our customer services.

Processing and disclosureWe may process and disclose personal data with and to group companies or business partners or third party service providers, for the purposes stated above.

In addition, there may be circumstances under applicable laws where we are permitted to collect, process and disclose personal data without your consent. You may obtain more information by contacting us (Please see contact details on our website under “Contact Us” tab).

a. input errors or misuse of its internet services;

b. negligent handling or sharing of Password;

c. leaving a computer unattended during an online session;

d. failure to immediately report known accidents of unauthorized account access.Member companies of PhillipCapital will never ask you for your Password. In order to ensure that you are the only person who knows this information: