Falling into resource debt

We ended off 2023 with the central outcome of COP28 – the Global Stocktake – which recognised the need for deep, rapid, and sustained reductions in greenhouse gas emissions in line with 1.5°C pathways. The Stocktake is expected to guide countries as they develop stronger climate action plans due by 2025.

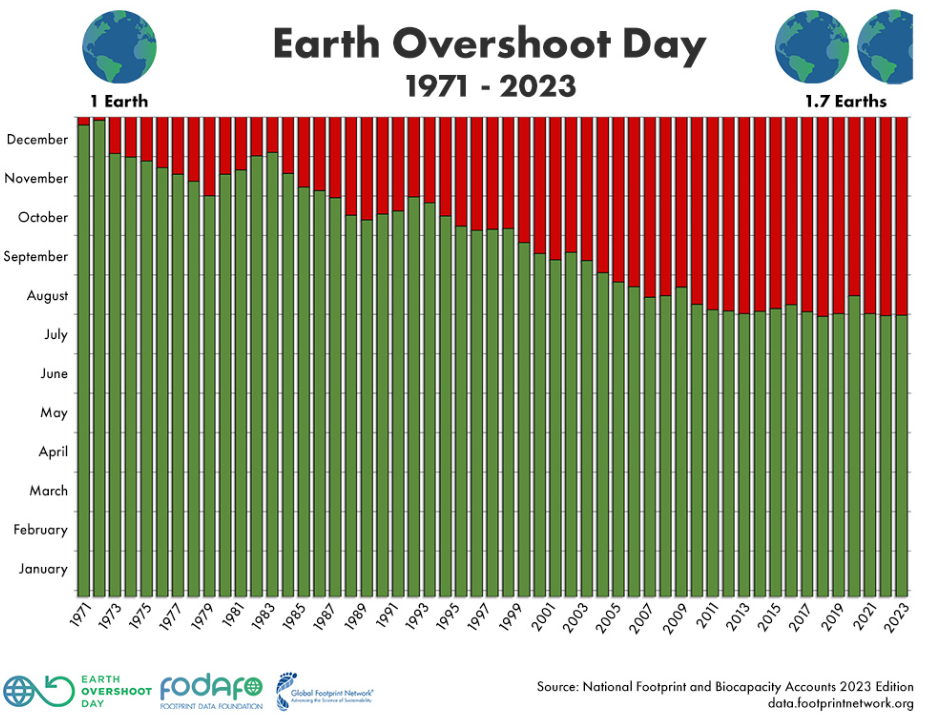

Photo: Earth Overshoot Day, Footprint Data Foundation and Global Footprint Network

Photo: Earth Overshoot Day, Footprint Data Foundation and Global Footprint Network

In 1900, human materials were comparable to just 3% of Earth’s biomass. By 2020, human materials exceeded Earth’s total living biomass (excluding water). We are producing materials at an unprecedented rate. In 2023, Earth Overshoot Day fell on August 2. This marks the day that human consumption of resources outpaced nature’s budget for the year. This means we would need about 1.7 Earths to support our demands on renewable natural resources. Each year, the date shifts forward – with this year’s Overshoot Day falling on July 25. We are now paying interest on our mounting debt in the form of food shortages, soil erosion, and burgeoning carbon emissions.

Without respecting the life-supporting functions of Earth, we risk destabilising liveability. We have already breached 6 out of 9 planetary boundaries – but charting a new course for thriving lives within the means of our planet is achievable. We need to bring human activity in balance with Earth’s ecological budget and move the Overshoot date to December 31 or later.

Recognising the link between climate and nature, the COP28 UAE Presidency and CBD COP15 China Presidency launched the first-ever joint statement on Climate, Nature and People. The statement signals the start of growing synergies between climate pledges, known as Nationally Determined Contributions (NDCs), and National Biodiversity Strategy and Action Plans (NBSAPs) of signatories.

The next two years are crucial for Parties as they are expected to come prepared with new climate pledges at COP30 in 2025. In the 2022 update to its NDC, Singapore pledged to peak absolute emissions before 2030 and reach 60 MtCO2e by 2030. This is an economy-wide target, covering sectors like energy, industrial processes, and product use and waste.

As for biodiversity, the Kunming-Montreal Global Biodiversity Framework sets an ambitious target to conserve 30% of land, waters, and seas by 2030. Singapore’s 2019 NBSAP lays the foundation for supporting the KMGBF. For example, it aimed to have 7% of land and 0.5% of marine areas as nature areas by 2020.

Looking forward

We are close to breaching boundaries that define a safe operating space for humanity. On the back of COP28, we have stronger impetus to avoid climate catastrophe and ecological collapse. Investors and businesses play a role in building a safer future. Under PCM ESG Research Objective 2 (Mitigating Negative Externalities), we support companies that are reducing water intensity and do not source from water-stressed regions. Under PCM ESG Research Objective 3 (Measuring Positive Change and Impact), we reinforce companies that invest in research and industrial technologies that are more resource-efficient and enable the decarbonisation of operations.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.