Portfolio Strategy: Play Defensive Leading to November 2020

The US stock market’s plunge on 3 September 2020 was a vindication that the equities market in the US has gotten too frothy. Despite economic fallout from the Covid-19 pandemic, valuations of US equities – particularly in the tech sector – had far been defying gravities to make record after record before the plunge. On the Thursday’s rout, tech-heavy Nasdaq Composite Index fell 5% from the peak of 12,056 to close at 11,458.

Still, selling pressures continue without any signs of abating and the Nasdaq Composite continued to drift lower. By 11 September, the Nasdaq Composite has failed to hold onto psychological support level at 11,000, closed around 10,853.

Since staging a V-shape recovery from March-low’s, the Nasdaq Composite had seen an extended rally and despite the recent tumble, the Nasdaq Composite was still up by about 20 per cent on a year-to-date basis. In our view, the latest tumble is foreboding a deeper correction, given how crowded the megatech trade had been.

US Market Frothy: Nasdaq Composite trend reversal – Expanding Bollinger Bands (elevated volatility), price action crossover Moving Average (“MA”) to downside.

Chart source: POEMS, Phillip Securities as at 18 September 2020.

Incidentally, we are foreseeing volatility to be elevated leading to US Presidential Election on 2 November 2020. In the last leg leading to election day, more aggressive posturing and rhetoric between the Presidential hopefuls will induce greater uncertainties in the markets. Given this backdrop, investors should buckle up and expect more profit-taking in the US stock market, which will cause a spillover effect and weigh on Singapore equities.

On the local front, albeit valuations of locally listed companies remained depressed, there is still no obvious catalysts insight which may help propel the market. The local benchmark Straits Times Index (“STI”) has also recently lost the critical support level to drop below 2,500.

Going forward, we believe the investment landscape will become increasingly challenging to navigate, especially leading to the third-quarter earnings season which will coincide with the US Presidential election. Therefore, investors should play more defensive in their strategy, given the broad picture.

SG Market showing no sign of strength: STI – Contracting Bollinger Bands signalling consolidation around 2,500-point. Price action yet to crossover MA towards upper limit to suggest continuing weakness.

Chart source: POEMS, Phillip Securities as at 18 September 2020.

Diversify, but capture fundamentals

In periods of great uncertainties, keeping to a diversified portfolio would be a prudent thing. However, a traditional market-cap weighted STI ETF, may not produce the desired effects of diversification from an investment standpoint. This is due to certain flaws about traditional market-cap weighted indices.

One subtle drawback which displaces the notion that traditional market-cap weighted indices are diversified is they tend to build up excessive concentration. For instance, portfolio weights would skew toward stocks with higher market capitalizations. Consequently, there is also a higher likelihood for concentration risk to build on a sector level in the portfolio.

The second crucial drawback of traditional market-cap weighted indices is that they are not risk-adjusted. In that sense, there are no strategies built in to capture the fundamentals of the constituents. This drawback compounds the problem because it could allow for higher allocation in underperforming sectors.

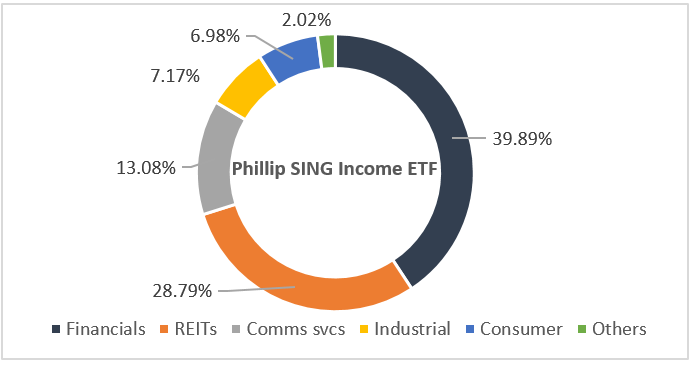

Phillip SING Income ETF (“SING Inc”) is designed to address the shortcomings of traditional STI ETFs. Firstly, SING Inc has capped weights on individual constituents at 10% to reduce concentration risk. In addition, SING Inc takes on a factor-based approach by assigning scores to rank constituents on quality (economic moat), distance-to-default (financial strength) and trailing 12-month dividend yield. Due to this approach, we have observed that SING Inc has outperformed traditional STI ETFs in our recent 1H2020 review.

One difference that we think will continue to underpin the outperformance of SING Inc is the lower allocation in the industrial sector. Due to the demand shocks from the pandemic, the impact on revenue stream would be disproportionately higher for the sector, in addition to their capital-intensive business (higher capex, i.e. capital expenditures). As at end-August 2020, the industrial sector accounts for 7.17% of the portfolio, compared to Nikko AM Singapore STI ETF’s 17.4% (end-August 2020) and SPDR STI ETF’s 15.64% (Industrials plus Oil & Gas; end-August 2020).

Meanwhile, SING Inc has a higher allocation in S-REITs (28.79%) which has served as a bedrock for returns during this period.

Source: Phillip Capital Management (“PCM”); as of 31 August 2020.

Source: Phillip Capital Management (“PCM”); as of 31 August 2020.

REITs For Stronger Stability

As briefly mentioned above, another angle to look for defensiveness is from the S-REITs space. We have observed that S-REITs as a whole has outperformed the STI in 1H2020. In our opinion, favourable government fundamentals would continue to underpin the healthier performance of S-REITs relative to other sectors. The new measures kicked-in during the start of the circuit breaker also included equipping S-REITs with more financial headroom for manoeuvring in the longer term.

Although general business activities have yet to recover to pre-crisis level, we believe the worst is over for S-REITs given the low possibility for the Singapore government to enforce another lockdown. On this note, traders and investors may be looking at S-REITs for potential recovery plays, given that valuations are still attractive compared to historic levels.

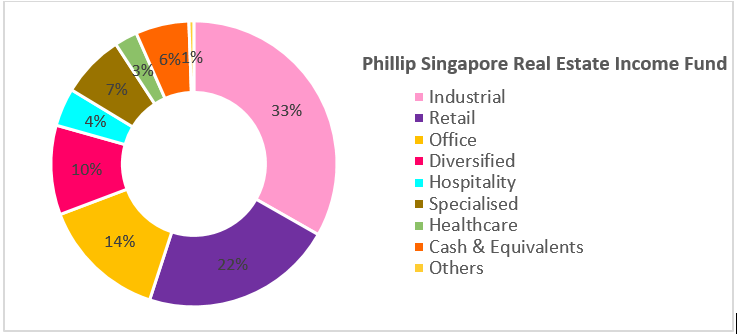

Nonetheless, within the S-REIT industry, selection and allocation would still be key. In Phillip Singapore Real Estate Income Fund, we view that S-REITs with strong sponsors, quality assets and healthy balance sheets with lower gearing would recover disproportionately quicker. Sector-wise, we are overweight in the industrial sector and continue to be underweight in the hospitality sector.

Particularly, we like the broad development of industrial and logistic REITs playing to the growth of e-Commerce and data centres. We view this phenomenon of industrial S-REITs expanding the portfolio mix with tech parks and data centres would drive greater value and hence is a significant long-term tailwind for the sector.

Source: PCM; as of 31 August 2020

Source: PCM; as of 31 August 2020

Enhance Yield Pick-up For Idle Monies

In view of looming greater uncertainties, risk-averse investors may choose to stay on the sidelines or keep a substantial amount of cash in their bank accounts. However, idling monies in savings accounts may not be the most optimal way to manage cash, given the close-to-zero interest rates that are being offered to individuals.

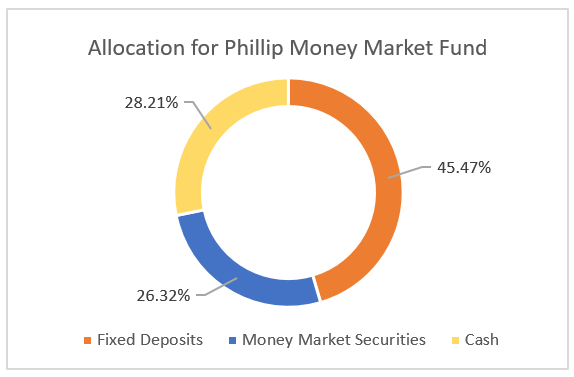

Instead, investors should park their sidelined funds or excess cash in defensive vehicles that are highly liquid. Phillip Money Market Fund (“PMMF”) is one such vehicle.

In spite of the low-interest rate marketplace, PMMF invests in high-quality[1] money market securities and deposits or private placement to established institutions to attain yield pick-up for unitholders. For context, the monthly yield (annualized) in August 2020 for PMMF was 0.331% versus the average bank savings deposit rate of 0.10% p.a.

Apart from higher efficiency, investors are also able to redeem their units on the day itself, with the caveat that requests are eventually received by the Manager before 11.30 am[2]. For this reason, investors can invest in PMMF without compromising on yield for liquidity or vice versa and allow them to capitalize when the market eventually stage a rebound.

As of 31 August 2020, PMMF has allocated about 73.68% into fixed deposits and cash. The remainder 26.32% is invested in money market securities, with a weighted average maturity of 42.5 days.

Phillip Money Market Fund

Portfolio Metrics As of 31 August 2020

Weighted Average Maturity: 42.5 days

Average credit rating: A

Asset Allocation

Fixed Deposits: 45.47%

Cash: 28.21%

Money Market Securities: 26.32%

Fixed deposits & cash: 73.68%

Source: PCM; 31 August 2020.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM. An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details. Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions. The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice. The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.