Blue lifeline for ocean investment

Earlier this year, we discussed the historic victory of the High Seas Treaty – an agreement that aims to protect waters beyond national jurisdiction from overfishing, pollution, and other threats. The Agreement was adopted by the United Nations in New York on 19 June 2023. Since opening for signatures in September, over 80 countries have signed the treaty – including US, China, EU, Indonesia, and Singapore.

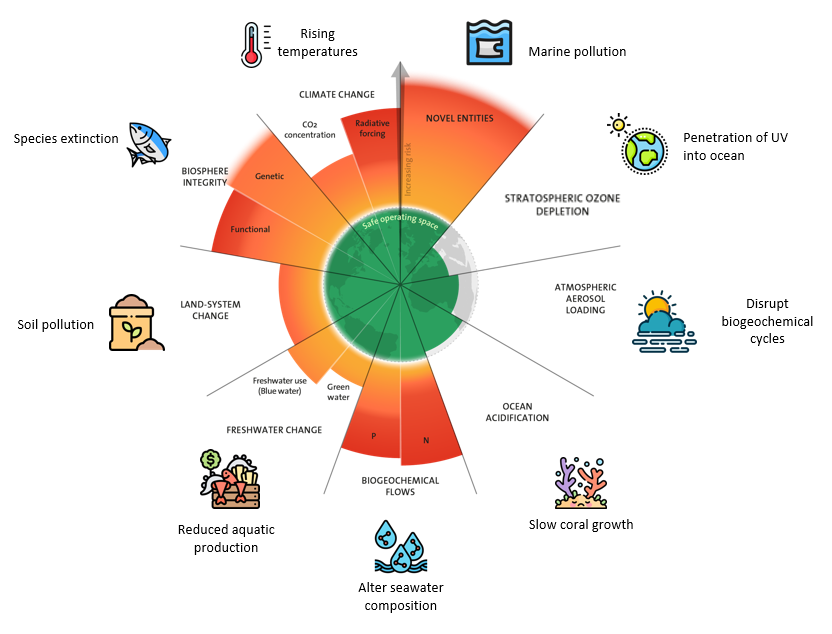

Last week, we touched on how six planetary boundaries have already been exceeded – including climate change and novel entities (referring to pollutants like plastics and industrial chemicals). Widespread pollution and overfishing threaten marine biodiversity and ecosystems. What’s more, human-associated carbon emissions not only worsen climate change, but also makes our oceans more acidic – further limiting its ability to store carbon (Quantis)

Photo: Adapted from Nash et al., 2017, Stockholm Resilience Centre, 2023. Icons made by Freepik from www.flaticon.com

Investment opportunities

Asia is home to some of the busiest shipping routes in the world, with a boost in exports from US and Europe manufacturers moving production from China to other Asian nations, – attracted by lower labour costs and lower trade barriers (Forbes). The region also provides an estimated 50% of global fishery production, valued at over US$51 billion (Southeast Asian Fisheries Development Center).

Vessels using shipping lanes that pass through MPAs will likely be subject to restrictions such as speed limits or bans on shipping activity. In anticipation of longer journeys, it may be worth exploring technologies which can improve fuel efficiency and curb emissions. At the same time, the Maritime Port Authority of Singapore is already looking towards a multi-fuel bunkering transition – working with technical committees to study the impact of biofuels on ship fuel consumption devices (MPA).

Last year, a Japanese shipping company successfully completed its third marine biofuel trial. At the Port of Singapore, the container ship was refuelled with 1,300 tonnes of marine biofuel – enough for a 45 day journey from Singapore to the Port of Cape Town and Port of Durban before returning to Southeast Asia. The biofuel product can serve as a substitute to petroleum-derived marine fuels – without needing modifications to existing fuel engines or infrastructure.

A key focus of the Treaty is to set up a procedure to establish large-scale Marine Protected Areas (MPAs) in the high seas – a crucial step towards effective conservation and management of 30% of land and sea by 2030, as agreed in the Kunming-Montreal Global Biodiversity Framework in December last year. Depending on the conservation focus and level of protection, MPAs have varying levels of protection. Some MPAs allow humans to access to the area but not permit extraction of natural and cultural resources – known as “no-take” zones (NOAA). Generally, MPAs provide at-risk species and habitats with a safe area for recovery, serving as a buffer against biodiversity decline.

As a country highly reliant on maritime trade and food imports, ocean health is vital for Singapore’s people and economy. Despite heavy maritime traffic, the country’s waters are home to over one third of global coral species. The Sisters’ Islands Marine Park – Singapore’s first marine park – is likely to be the source of the country’s coral diversity. Some reefs there have been found to be “mother reefs” – supplying coral larvae which migrate to the Southern Islands after spawning.

Looking forward

The ocean absorbs a quarter of all carbon emissions and captures about 90 percent of excess heat (UN). As the largest habitat in the world, the ocean plays a crucial role in supporting the living organisms that store carbon. To combat climate change, it is crucial that the ocean remains healthy and is able to provide these services.

We expect companies to be taking management actions to promote sustainable use of ecosystems – advancing progress under Global Biodiversity Framework Goal A. We account for how companies ensure management actions to reverse biodiversity loss in PCM ESG Research Objective 3 (Measuring Positive Change and Impact). In our climate analysis, we evaluate how companies are combating climate change and its impacts by setting forward-looking decarbonisation strategies and taking steps to achieve them. In supporting companies’ strategic business transformations from carbon-intensive business models to low carbon alternatives, we reinforce progress towards SDG 13 (Climate Action).

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.